Negative growth in Q4 rounds off disappointing year for builders’ merchants

Negative growth in Q4 rounds off disappointing year for builders’ merchants

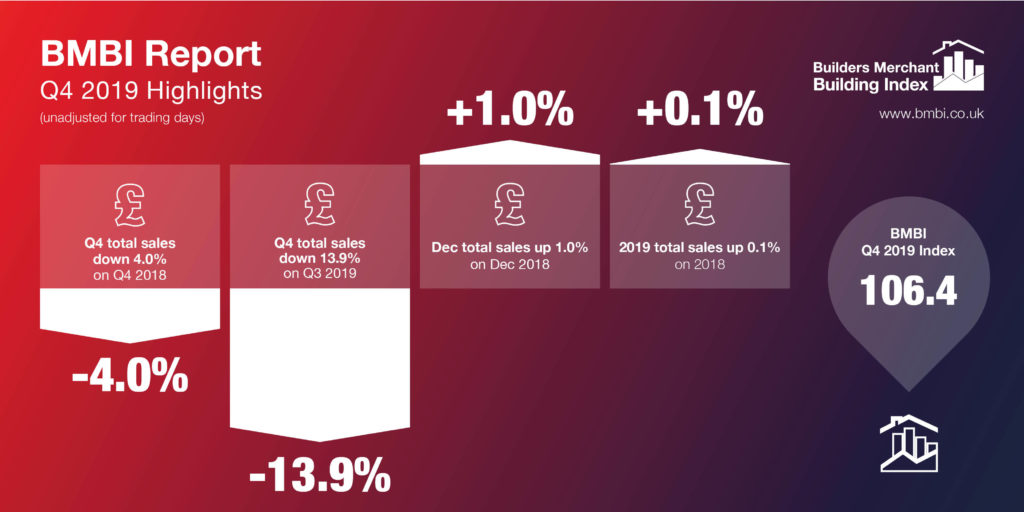

Sales figures for the final quarter of 2019 published in the Q4 2019 Builders Merchants Building Index (BMBI) report, round off a disappointing year for the sector, with a third consecutive quarter of negative growth.

Year-on-year

Total Builders’ Merchant value sales in Q4 2019 were -4.0% down compared with the same quarter in 2018. Adjusted for trading days, average sales a day dropped -2.4%.

Tools (-8.5%) and Timber & Joinery (-6.7%) were particularly affected, closely followed by Heavy Building Materials (-4.6%). The best performing sectors year-on-year were Renewables & Water Saving (+6.4%) and Workwear & Safetywear (+5.8%).

Quarter-on-quarter

Total value sales dropped -13.9% in Q4 2019 compared with Q3 2019. The drop was less marked when adjusted for trading days (-5.2%).

Most product categories reported lower value sales over the period, with sales of the seasonal category landscaping down the most, by -33.2%, followed by Heavy Building Materials (-14.8%) and Timber & Joinery Products (-13.1%).

The only two categories to report quarter-on-quarter growth were Workwear & Safetywear (+11.2%) and Plumbing, Heating & Electrical (+3.8%).

Index

The total BMBI index for Q4 2019 was 106.4, a significant drop from 123.6 in Q3 2019. The index for Heavy Building Materials was 105.0.

Emile van der Ryst, Senior Client Insight Manager – Trade, at GfK says: “2019 will go down as one of those years most of us won’t forget, as the Brexit drama dominated headlines and created uncertainty across all spheres of business in the UK, including the Builders’ Merchant industry. Within the Builders’ Merchants this only told one part of the story, as a review of the whole year reveals the effect that weather can have.

“2019 vs 2018 year to date growth sat at 6.2% after Q1, but gradually came down as the year progressed. After Q2, this growth figure dropped to 2.3% and then further down to 1.3% after Q3. We finally end the year with 2019 only seeing an increase of 0.1% against 2018, albeit having one less trading day.

“Within Heavy Building Materials there have been small declines in most key areas such as Bricks, Blocks, Roofing and Aggregates, with Plaster & Plasterboard the big winner in the past year. Both Timber and Sheet Materials saw declines within the Timber & Joinery category, with Cladding and Flooring the areas with the most positive growth.

“2020 brings a new decade full of opportunities and challenges, but it should be a relief that Brexit won’t be part of the public discourse for much longer. Storms Ciara and Dennis have just passed and could be a further indication of the increased erratic weather seen across the UK. Looking ahead in 2020 it will be interesting to see what role weather will play in the Builders’ Merchants industry and how it will affect growth as the year moves along.”

The BMBI uses GfK’s point of sale tracking data drawn from over 80% of builders’ merchants’ sales throughout the country, making it the most reliable source of data for the sector.

The latest Q4 2019 full report is available to download at www.bmbi.co.uk. The report includes in-depth analysis and trends from GfK data, and comments from 15 industry leading experts on their respective markets.